A line of credit refers to some financial loan from the lender or other monetary institution that makes a certain quantity of credit accessible to the borrower for them to draw on as wanted, instead of taking all at once.

Our editorial group receives no immediate compensation from advertisers, and our articles is totally simple fact-checked to make sure precision. So, regardless of whether you’re looking through an post or a review, you are able to believe in that you choose to’re receiving credible and trustworthy info.

We manage a firewall amongst our advertisers and our editorial staff. Our editorial group does not acquire immediate compensation from our advertisers. Editorial Independence

Editorial Policy: The data contained in Request Experian is for instructional reasons only and isn't authorized advice. It is best to consult your possess attorney or search for particular assistance from a lawful Experienced about any legal issues.

Ebony Howard is actually a certified general public accountant and also a copyright ProAdvisor tax expert. She continues to be within the accounting, audit, and tax job for much more than thirteen decades, working with individuals and several different providers from the overall health care, banking, and accounting industries.

A credit report is usually a history of your dealings with credit. When you've employed credit, you most likely have three credit reviews, one particular from Just about every on the three nationwide credit reporting businesses: Experian, TransUnion and Equifax.

Offer pros and cons are based on our editorial team, according to impartial analysis. The financial institutions, lenders, and credit card corporations aren't liable for any content posted on This page and don't endorse or guarantee any testimonials.

The location supplies rates from 13 unique house financial loan organizations in order to look for the most effective mortgage fees. Some lenders even provide a no closing Charge mortgage, but Individuals might have other drawbacks or rigid requirements for approval.

Bankrate’s editorial workforce writes on behalf of YOU – the reader. Our goal would be to provide you with the ideal guidance to help you make intelligent individual finance choices. We adhere to stringent recommendations to make certain that our editorial written content is not affected by advertisers.

Your fiscal heritage influences your capacity to qualify for the most effective mortgage charges. On the whole, you must intention for the credit score of at the very least 740 to save lots of by far the most dollars feasible on interest.

“This service was magnificent. here I didn't have to pay for anything at all up front and acquired just what I was looking for instantly.”

Line of Credit (LOC) Definition, Styles, and Examples A line of credit is definitely an arrangement concerning a lender as well as a customer that establishes a preset borrowing limit which might be drawn on continuously.

Test your credit rating. Prior to deciding to make an application for credit, it is vital to find out where you stand. Checking your credit rating is The best approach to gauge your creditworthiness.

When implementing for credit, your creditworthiness is definitely the lender's appraisal of your ability to repay any debt you incur. Along with your credit score, your creditworthiness might also consist of:

Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Shannon Elizabeth Then & Now!

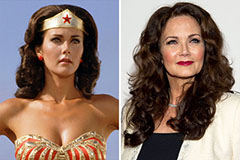

Shannon Elizabeth Then & Now! Lynda Carter Then & Now!

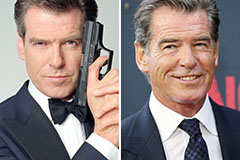

Lynda Carter Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!